Options for Deposit Insurance Reform to Stabilize Our Banking System and Protect Depositors

June 28, 2023

By Emily DiVito

“The existence of FDI—and the Federal Deposit Insurance Corporation (FDIC) that administers it—offers eligible bank customers peace of mind so that they are not inclined to withdraw their deposits en masse. It thus acts as a stabilizing force to the banking system as a whole.”

I. Introduction: Recent Bank Failures Highlight the Importance—and Potential—of Deposit Insurance

Since the banking panics of the early 1930s, the US has offered federal deposit insurance (FDI) on eligible deposit accounts (including checking and savings accounts) up to the statutory limit of $250,000. FDI has been remarkably successful in preventing bank runs and mitigating financial panic—until recently. The collapses of Silicon Valley Bank (SVB), Signature Bank, and First Republic Bank (FRB) have exposed vulnerabilities in—or at the very least cast doubt on—FDI’s current terms and structure. Is FDI protecting the “right” depositors at the “right” coverage threshold? Is it maximizing the government’s ability to avert a financial crisis and, if one occurs, contain it with minimal contagion to the rest of the US economy? And finally, because FDI applies to individual and institutional depositors alike, who is the banking system for and what does that imply about the government policies and practices in place to serve them?

The existence of FDI—and the Federal Deposit Insurance Corporation (FDIC) that administers it—offers eligible bank customers peace of mind so that they are not inclined to withdraw their deposits en masse. It thus acts as a stabilizing force to the banking system as a whole. Most of the time, this intangible government guarantee is sufficient to keep banking stable. But depositors can still panic about the uninsured deposits over $250,000. And, as the SVB, Signature, and FRB crises have demonstrated, when uninsured depositors panic, it threatens the entire US banking system.

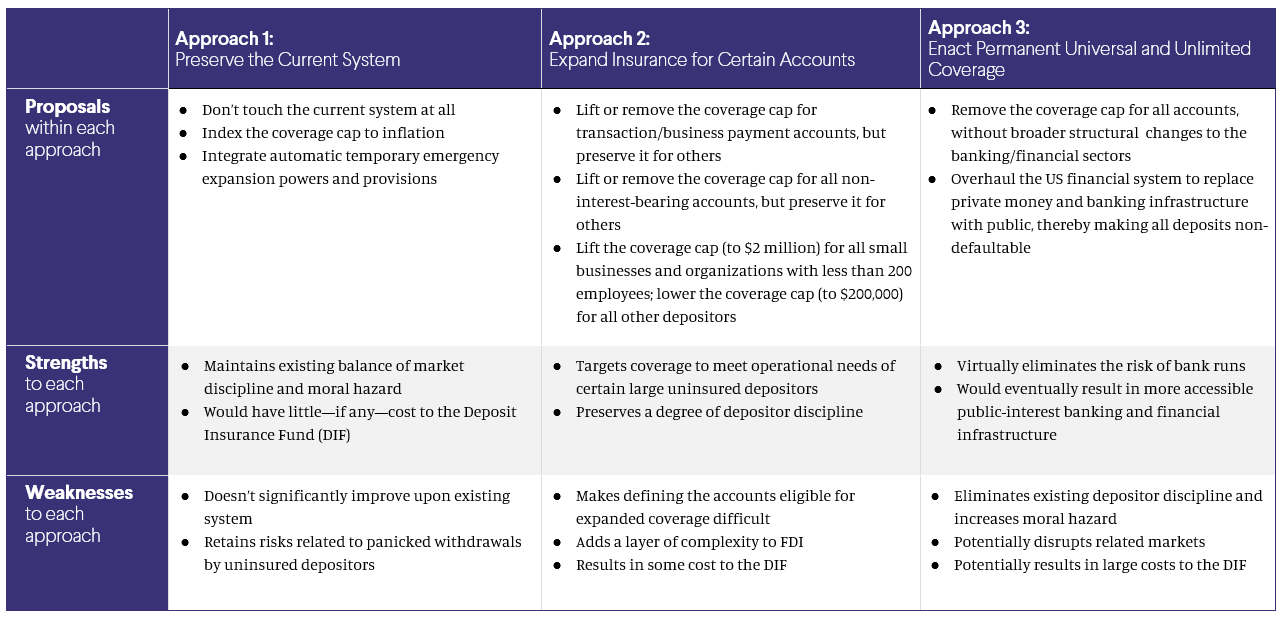

Taking lessons from the recent bank failures, many experts have proposed FDI reforms. These proposals vary widely, but all reckon with similar themes: financial stability, depositor protection, market discipline, and moral hazard. This brief aims to synthesize this bevy of proposals to better understand the policy trade-offs each carries and what these choices say about the larger purpose of our banking system. Though the ultimate aim of each reform is ensuring US financial system stability and depositor protection, each comes to that end through very different sets of arguments. When taken together, three main approaches emerge:

- Preserve the Current System: One approach holds that current FDI is mostly functioning well and as intended, and any significant changes could invite moral hazard. To the extent that recent bank crises warrant policy changes, this approach advocates for modest tweaks—such as linking the coverage limit to the price level or incorporating temporary emergency provisions—in order to inject more resiliency into FDI.

- Expand Insurance for Certain Accounts that could Bring Market Discipline to Bear: A second approach, favored by the FDIC, considers the unique position of large business accounts—which are often uninsured and able to trigger destabilizing panic, but not likely to effectively monitor bank risk-taking—and concludes that increased coverage for certain types of depositors is warranted. The types of accounts eligible for expanded coverage under this approach to reform could include transaction or business payment accounts, all non-interest-bearing, and/or those owned by small- to mid-sized employers.

- Enact Universal and Unlimited Coverage: Finally, a third approach to FDI reform maintains that US banking will be vulnerable to acute crises as long as uninsured depositors exist. To that end, this approach supports universal and unlimited deposit insurance. More fundamentally, however, this approach seeks to reckon with questions about the relationship between private financial institutions and the US government, pointing to the need for alternative public banking infrastructure.

Deposit insurance has been a lynchpin to US financial stability and a godsend to otherwise-anxious depositors since the Great Depression. To ensure FDI always serves those functions well and when needed, policymakers must consider what shortcomings and opportunities for reform—if any—the SVB, Signature, and FRB crises have revealed about the current system.

Separate from successfully passing and implementing any potential reform legislation, having debates on these long-ignored questions is a valuable exercise that benefits US financial institutions and the depositors who rely on them.

Figure 1. The Range of Federal Deposit Insurance (FDI) Reforms

Related Resources

Banking for the People: Lessons from California on the Failures of the Banking Status Quo

BriefEmily DiVito presents findings from a new and original field survey of California bank branches in order to underscore the shortcomings of the current US banking industry.

How 2018 Regulatory Rollbacks Set the Stage for the Silicon Valley Bank Collapse, and How to Change Course

Blog PostRoosevelt Fellow Todd Phillips explores the recent failure of Silicon Valley Bank and discusses what Congress can do to mitigate the risks of future bank failures.