What Could Be the Most Important Tax Case of the Century

October 6, 2023

And how it could increase corporate power.

The Roosevelt Rundown features our top stories of the week.

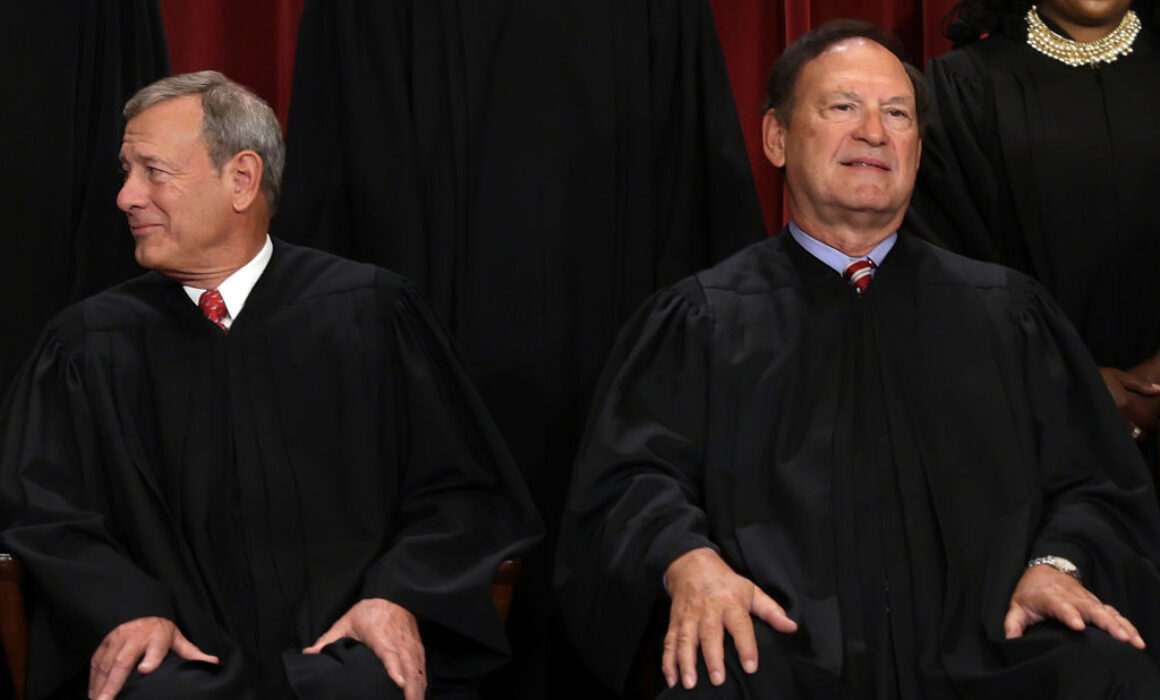

US Supreme Court Chief Justice John Roberts and Associate Justice Samuel Alito

What Moore v. United States Means for Corporate Power

The Supreme Court’s term began this week—and with it arrives what could become the most important tax case of the century.

In Moore v. United States, a broad decision from SCOTUS could jeopardize many laws that currently prevent corporations and individuals from avoiding taxes.

A new brief from the Roosevelt Institute and the Institute on Taxation and Economic Policy (ITEP) explores both the larger stakes of the decision and how much specific corporations stand to save if SCOTUS strikes down the Mandatory Repatriation Tax.

As Niko Lusiani, Matt Gardner, and Spandan Marasini find, if this tax were ruled unconstitutional for corporations, almost 400 multinational corporations would collectively be granted $271 billion in tax relief by the Roberts Court. Moreover, they find that Chief Justice John Roberts and Justice Samuel Alito together hold stock in 19 companies set to receive more than $30 billion in tax relief from such a decision.

Read more in “Supreme Corporate Tax Giveaway: Who Would Benefit from the Roberts Court Striking Down the Mandatory Repatriation Tax?”

How the IRS Can Advance Racial Equity

“On September 19, 2023, the Treasury Advisory Committee on Racial Equity (TACRE) gathered to discuss ways the Treasury Department can further support and advance the work of the Biden administration in achieving a whole-of-government approach to racial equity,” Roosevelt President and CEO Felicia Wong writes for the blog.

“[O]ne of the most exciting current opportunities to achieve this vision is through the IRS Modernization plan.”

Learn more about the plan, and how Direct File and reorienting auditing priorities can increase racial equity and rebuild capacity, in Wong’s latest.

Introducing the Bidenomics Brief

Bidenomics is already starting to succeed at many of its goals, including rebalancing power toward workers, as Roosevelt’s Alí Bustamante wrote this week.

But the fight over Bidenomics—what it really means, whether it’s working, and why it matters—is still underway.

In our just-launched newsletter, the Bidenomics Brief, we’ll be analyzing the big debates and developments of this moment, and explaining the new rules for the economy as they’re built from the ground up.

Sign up for the Bidenomics Brief, and get caught up with the first edition.

What We’re Talking About

Unemployment stayed at 3.8%. But who is counted as unemployed shifted last couple months. Much more likely to be "new entrants/reentrants" than earlier 2023.

That's great. That's who we want in unemployed, people pulled into the labor market (not job losers). Expanded supply. /2 pic.twitter.com/3Aeyi8XwYs

— Mike Konczal (@mtkonczal) October 6, 2023

What We’re Reading and Listening to

Setting the Record Straight on Inflation [podcast feat. Mike Konczal] – Pitchfork Economics

The Government’s Case to Break Up Amazon, Explained – Vox

What’s Next for American Democracy? – Democracy Journal