Is Ted Cruz Right About the Federal Reserve and the Great Recession?

January 28, 2016

By Mike Konczal

Is Ted Cruz right about the Great Recession and the Federal Reserve? From a November debate, Cruz argued that “in the third quarter of 2008, the Fed tightened the money and crashed those asset prices, which caused a cascading collapse.”

Fleshing that argument out in the New York Times is David Beckworth and Ramesh Ponnuru, backing and expanding Cruz’s theory that “the Federal Reserve caused the crisis by tightening monetary policy in 2008.”

But wait, didn’t the Federal Reserve lower rates during that time? Their argument is that the Federal Reserve didn’t lower them fast enough. “Through acts and omissions, the Fed kept interest rates and expected interest rates higher than appropriate, depressing the economy.” This is passive tightening, where the Federal Reserve didn’t act throughout the summer of 2008 to the gathering storm. Without it, “[w]e could have had a decline in housing without a Great Recession.”

Beckworth has discussed this at length in his blog. If it becomes more central to the economic debate in 2016, there’s four things to keep in mind.

1 – Consistent?

I do not see a logically consistent way Ted Cruz can hold his positions. Because in addition to the above, Cruz also says: “What the Fed is doing is dangerous [….] They are debasing the currency with QE1, QE2, QE infinity!” He says this a lot, and a lot of other stuff like this.

I don’t see how you can attack the Federal Reserve for not doing more monetary easing in 2008 while also attacking what we now call QE1, which was the Federal Reserve doing monetary easing in 2008. Is the story really that QE1 would have saved the world if done in April of 2008, but since it was done in November it’s a dangerous debasement of our currency?

If the story of the Great Recession is one of the Federal Reserve being too tight, then you should welcome QE2 and QE3, not attack them. So I imagine this is more about moving the “blame government” rhetoric to the Great Recession, rather than having a consistent insight into the economy.

2 – Stimulus

A lot depends on what we mean by “cause.” Google “define:cause” and I get “make (something, typically something bad) happen.” But the authors really mean “didn’t prevent” here. There is a fascinating Myth of Ownership/”you didn’t build that” element here – where is the line between the market and the state that structures it? But the story is simple: there was an aggregate demand shortfall from the housing collapse, and the government didn’t step in to fix it.

In that same exact way, the stimulus not being large enough also caused the Great Recession. Sure, but I doubt Ted Cruz would agree with that statement.

3 – Ambiguity

I think a lot of people’s frustrations with the article – see Barry Ritholtz at Bloomberg here – is the authors slipping between many possible interpretations. Here’s the three that I could read them making, though these aren’t actual quotes from the piece:

(a) “The Federal Reserve could have stopped the panic in the financial markets with more easing.”

There’s nothing in the Valukas bankruptcy report on Lehman, or any of the numerous other reports that have since come out, that leads me to believe Lehman wouldn’t have failed if the short-term interest rate was lowered. One way to see the crisis was in the interbank lending spreads, often called the TED spread, which is a measure of banking panic. Looking at an image of the spread and its components, you can see a falling short-term t-bill rate didn’t ease that spread throughout 2008.

And, as Matt O’Brien noted, Bear Stearns failed before the passive tightening started.

(b) “The Federal Reserve could have helped the recovery by acting earlier in 2008. Unemployment would have peaked at, say, 9.5 percent, instead of 10 percent.”

That would have been good! I would have been a fan of that outcome, and I’m willing to believe it. That’s 700,000 people with a job that they wouldn’t have had otherwise. The stimulus should have been bigger too, with a second round once it was clear how deep the hole was and how Treasuries were crashing too.

(c ) “The Federal Reserve could have stopped the Great Recession from ever happening. Unemployment in 2009 wouldn’t have gone above 5.5 percent.”

This I don’t believe. Do they? There’s a lot of “might have kept that decline from happening or at least moderated it” back-and-forth language in the piece.

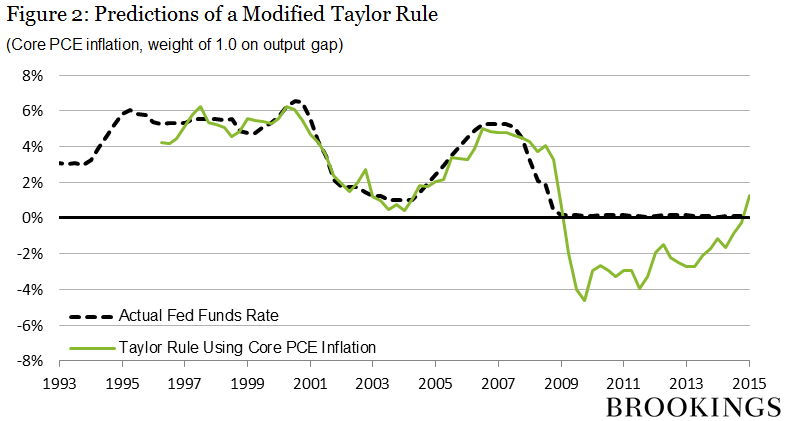

Is the argument that we’d somehow avoid the zero-lower bound? Ben Bernanke recently showed that interest rates would have had to go to about -4 percent to offset the Great Recession at the time. Hitting the zero-lower bound earlier than later is good policy, but it’s still there.

I think there’s an argument about “expectations,” and “expectations” wouldn’t have been set for a Great Recession. A lot of the “expectations” stuff has a magic and tautological quality to it once it leaves the models and enters the policy discussion, but the idea that a random speech about inflation worries could have shifted the Taylor Rule 4 percent seems really off base. Why doesn’t it go haywire all the time, since people are always giving speeches?

And couldn’t it be just as likely that since the Fed was so confident about inflation in mid-2008 it boosted nominal income, by giving people a higher level of inflation expectations than they’d have otherwise? Given the failure of the Evans Rule and QE3 to stabilize inflation (or even prevent it from collapsing) in 2013, I imagine transporting them back to 2008 would haven’t fundamentally changed the game.

4 – Shovel Ready

If your mental model is that the Federal Reserve delaying something three months is capable of throwing 8.7 million people out of work, you should probably want to have much more shovel-ready construction and automatic stabilizers, the second of which kicked in right away without delay, as part of your agenda. It seems odd to put all the eggs in this basket if you also believe that even the most minor of mistakes are capable of devastating the economy so greatly.