What Does Powell Think about Wages Now?

February 10, 2023

By Mike Konczal

Throughout 2022, Federal Reserve Chair Jerome Powell emphasized that wage growth was too high—that, as he said in November, “nominal wages have been growing at a pace well above what would be consistent with 2 percent inflation over time.” He didn’t explain why, and nobody pushed him, given that wage growth was in fact much higher than it had been over previous decades and what we’d expect given labor market tightness.

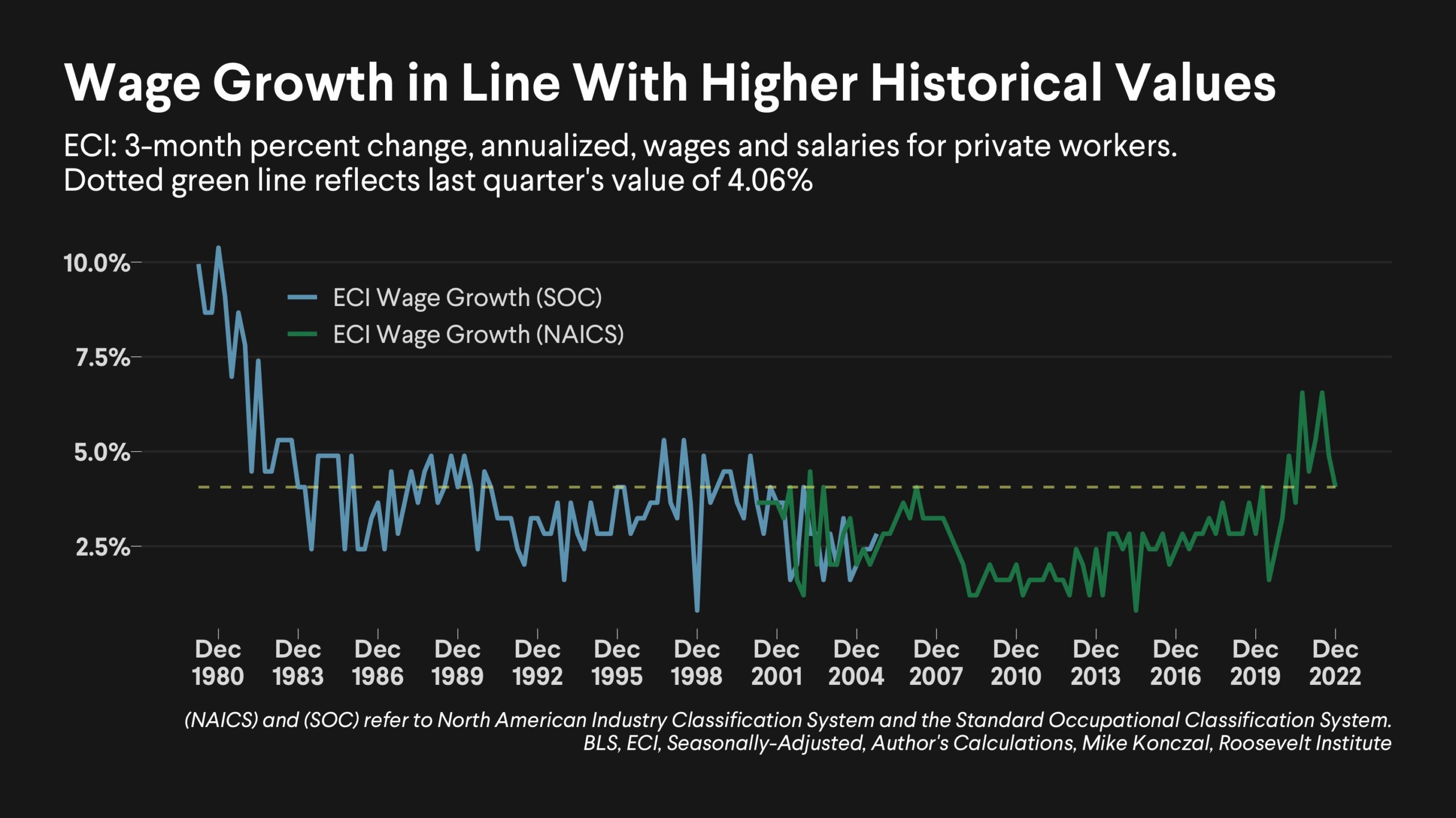

However, wage growth decelerated with the recent Employment Cost Index (ECI)—from around 5.5 to 6 percent annualized to near 4 percent, something much closer to what we would predict. Powell hasn’t said anything specific about these new numbers, but why he might think wages still need to slow down to fight inflation matters greatly for how much policy will tighten.

Here are some questions I’d like to know—ones I’m genuinely uncertain how he’d answer:

- Can we sustain 4 percent wage growth with low inflation, like we did in the 1990s?

- Do we no longer think weak job turnover has economy-wide effects?

- Do we have a de facto labor force dynamism target, and what are the consequences of that?

There are a lot of ways to measure labor-market tightness. The quit rate is one I emphasize. People who voluntarily leave their job generally do so for good reasons: a new job, the hopes of a new job, or the ability to sustain spending without wage income. The quit rate proxies for job-to-job transitions, one of the best indicators of wage growth (Karahan et al. 2017). It creates job openings, which in turn are filled with other people leaving their jobs; these vacancy chains are an important benefit for the labor market (Rose, Akerlof, and Yellen 1988).

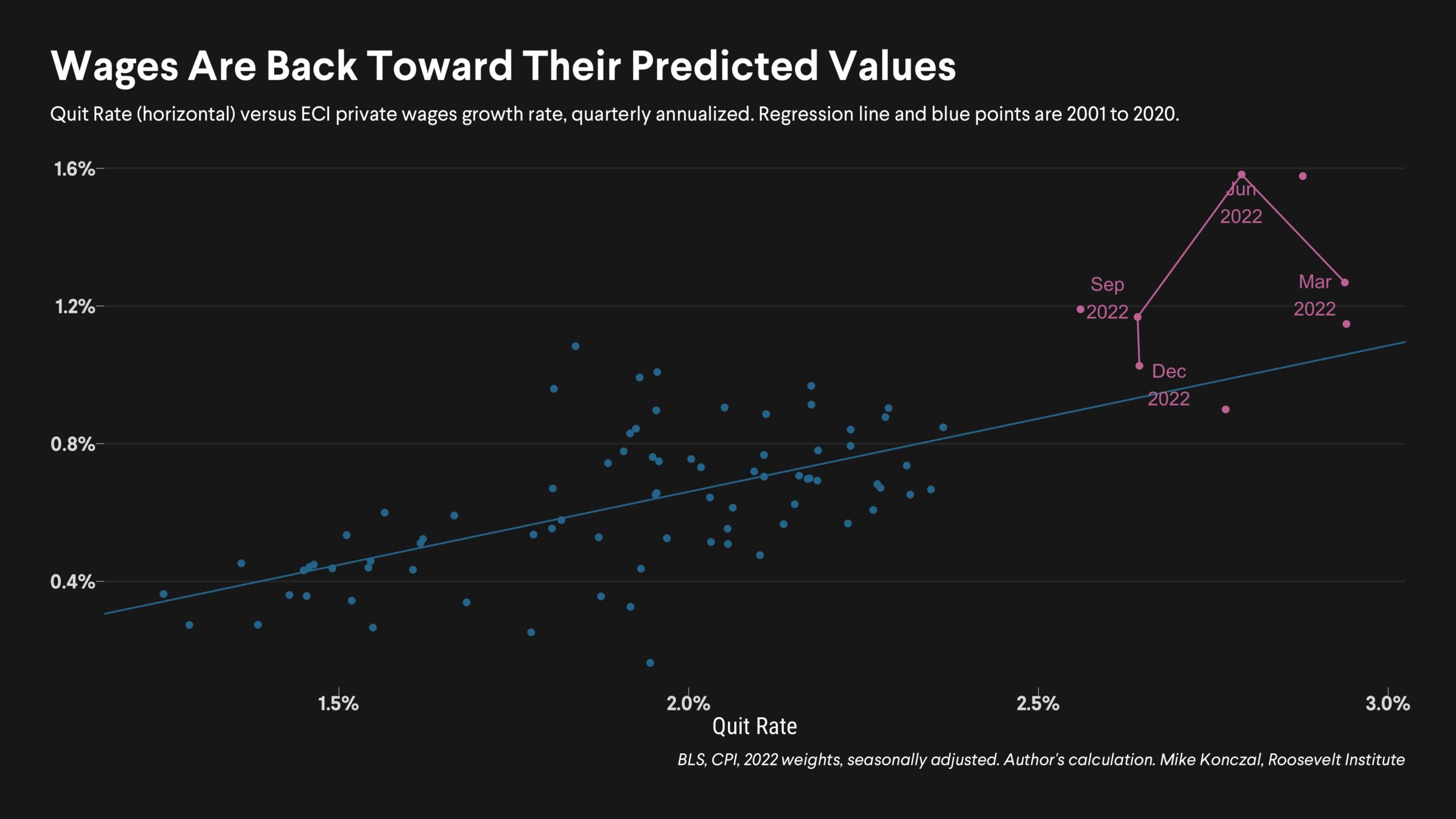

Figure 1, below, charts the quit rate versus quarterly ECI private-sector wage growth from 2001 to 2020 (in blue), and draws the regression line of this relationship through it. In purple, the chart shows the points from 2021 to 2022—with the last several quarters labeled.

Figure 1

In December 2021, Powell responded to a question from New York Times reporter Jeanna Smialek on high ECI growth, “if you had something where [increases in] real wages were persistently above productivity growth, that puts upward pressure on, on firms, and they raise prices. It would take something that was persistent and material for that to happen. And we don’t see that yet.” It was the 2022 ECI values, which were between 5 and 6 percent annualized, and well above trend, that seemed to have changed his mind.

During the second half of 2022, labor market tightness relaxed, with the quit rate decreasing from 3 percent to 2.7 percent. But the real change has been, for a given level of tightness, wage growth has declined to trend. And now, with the December 2022 print, we are close to the trend line. If it was the case, as I argued previously, that wages were pushed up above normal tightness trend from the weakening of employer monopsony power in the bottom end of the occupational income distribution, as shown by Autor, Dube, and McGrew, and by a mix of repeated sectoral reallocations (Guerrieri et al. 2021), that might have leveled out. Is it time to change back?

From speeches and responses to questions, we know what Powell thought about wages in 2021 and 2022. But what does he make of the following questions now?

Can we sustain 4 percent wage growth with low inflation, like we did in the 1990s?

When nominal wage growth was 5.5 percent and above, it was easy to understand why Powell and others did not need to justify their claims that it wasn’t consistent, over the medium term, with 2 percent inflation. But the December ECI number had wage growth at an annualized 4.18 percent rate. If it was on the trendline, it would be around 3.89 percent. Can we bring down inflation to 2 percent with that level? And if not, why? We were able to do it in the late 1990s without increasing inflation.

Figure 2

One response I often hear to this question is that we couldn’t sustain this level of wages given the productivity growth of the 2010s. But is that the right baseline? The 2010s featured a drought of dynamism and investment that naturally led to lower productivity. But I see no reason to make that assumption now, given the current rush of investment and dynamism. At the very least, this question needs to be more central. With a little bit of productivity growth and a decline in corporate margins, inflation is more than manageable.

Do we no longer think weak job turnover has economy-wide effects?

central debate during the Great Recession was why the American economy and culture simply couldn’t sustain a dynamic labor market. Though funny to remember now, the central problem both economists and commentators faced in the previous decade was: Is it even possible to get people to quit to switch jobs?

In a 2013 Wall Street Journal article titled “Risk-Averse Culture Infects U.S. Workers and Entrepreneurs,” Ben Casselman worried that, “Americans start fewer businesses and are less inclined to change jobs or move for new opportunities,” and wondered if this was due to “broader, more permanent shifts.” (It wasn’t, it was weak demand.) In a 2016 New York Times article, “Fewer Americans Strike Out for New Jobs, Crimping the Recovery,” Patricia Cohen asked, “Is a less fluid labor market causing the economy to be more sluggish or is a sluggish economy causing the labor market to be less fluid?” (The latter.) That article quotes economist Betsey Stevenson, who noted the possibility that “people stay in jobs that aren’t as good for them because they’re terrified of changing, and that’s bad for the overall economy.”

In 2015, the Council of Economic Advisers, then headed by Jason Furman, dove into this question in its Annual Report, finding:

Reduced [labor market] flows could be cause for concern, however, because they may undermine workers’ abilities to improve their employment situations. In particular, reduced fluidity may preclude employees from realizing the wage gains of switching jobs or make it difficult for part-time workers to find full-time work or result in fewer high-paying jobs in productive industries. […]

Other consequences of lower fluidity are perhaps more speculative but warrant careful observation nonetheless. Greater fluidity—or more precisely the conditions and institutions that enable greater fluidity—may prevent the share of long-term unemployed from rising, and may thereby reduce the negative consequences of long-term unemployment. More fluid labor markets may also be more resistant to cyclical shocks, or, at minimum, may experience faster recoveries after a recession (Blanchard and Wolfers 2000). If this is the case, the slower recoveries in the shares of part-time for economic reasons and in long-term unemployment in recent recessions could in fact be related to the long-run decline in fluidity.

Did we just give up on the goal of increasing dynamism? A decade of worrying about the large-scale consequences of decreased dynamism, reversed on a dime to conclude that it’s a matter of public policy to keep people from switching jobs?

Do we have a de facto labor force dynamism target, and what are the consequences of that?

The Fed has a formal inflation target. However, as it scrambles to center poorly predictive measures of wages on non-housing services, it’s acting as if there’s a secret wage target. But if the quit rate is a good measure of tightness and wage growth, is it fair to say that the Fed has a labor market dynamism target? If the quit rate is over the 2019 level of 2.3 percent, will it tighten? Powell has mentioned the level of vacancies throughout 2022, which I had assumed was a proxy for the high wages we saw. But as wages lower, is the Fed looking to target specific JOLTS numbers?

I ask for two reasons: First, productivity is related to dynamism—both compositionally, as workers move to higher-wage and higher-productivity occupations and industries as the economy grows, and in potentially creating more productivity and growth in the economy overall. If the Fed contains dynamism at a lower level, it may very well reduce the productivity that allows for the economy to grow at the same time.

Second, there are all kinds of policies designed to increase dynamism and people switching jobs—including occupational licensing reform, bans on noncompete clauses, universal or portable benefits like health care, and so on. All these would be expected to increase the quit rate. However, if the Fed thinks the quit rate we see is currently too high, would all these reforms accomplish the Fed tightening faster to offset the benefits? If so, are we locking ourselves into secular stagnation via this policy? I worry the Fed backed itself into a corner here, where patience would be the best way out.