Five Reasons Why the CBO Underestimates Federal Investment

June 7, 2021

By Emily DiVito, Mike Konczal

As policymakers invest in infrastructure, jobs, and solutions to the climate crisis, many will be looking at the Congressional Budget Office (CBO) and its methodology for determining the benefits of public investment. The methodology the CBO uses, like all economic models, has strengths and weaknesses depending on what kinds of questions need to be answered. For many things, such as the projected costs of straightforward spending programs, these methods are sound and have a good record of success. In general, we hope that any assumptions in economic modeling will tend to balance out.

But when it comes to investments, especially in climate measures, the methods the CBO uses have a strong bias against public action, for these five reasons:

- The CBO admits it has “no basis” for estimating future savings, or even the effectiveness, of climate change mitigation or adaptation efforts.

- The CBO adheres to a narrow budget window and adopts traditional definitions that undermine the full impact of federal investment.

- The CBO assumes that federal investment has half the rate of return of private investment.

- The CBO assumes that deficit-financed federal investment would raise interest rates, crowd out private investment, and result in future negative economic growth, independent of the economic trends we’ve seen in the past 20 years.

- Since the CBO only counts revenues that result from legislation if such legislation changes the tax code, any revenues from expanded IRS enforcement are ignored.

Let’s examine each more closely.

The CBO admits it has “no basis” for estimating future savings, or even the effectiveness, of climate change mitigation or adaptation efforts.

In its April 2021 report Budgetary Effects of Climate Change and of Potential Legislative Responses to It, the CBO describes:

Investment by the government or others in various types of mitigation or adaptation efforts could reduce the costs of climate change. The benefits of successful investments would generally accrue gradually over many years and might be only partially reflected in future savings to the federal budget. The extent of future budgetary savings might sometimes be a small proportion of the up-front costs. Currently, CBO has no basis for estimating future savings, because many of the linkages between climate change and the federal budget require further assessment.

This is often the problem with cost-benefit estimates for investments. The upfront costs are well recorded, but the benefits are diffuse, widespread, and incorporated over a much longer period. Here, the federal government’s budgeting system and the CBO’s inability to quantify future savings on climate spending mean that the relative cost (compared to the cost of climate catastrophe from not implementing sound mitigation/adaptation efforts) isn’t captured in CBO assessments.

This is even more difficult because the CBO does not have climate expertise. In order to quantify savings, the agency admits it doesn’t know (and would need to know) the effectiveness of mitigation policies, the relation of those effects to specific revenue sources and spending programs, and the extent to which reinforcing or offsetting changes in emissions would occur in other countries in response to policy changes in the United States.

Certainly, projecting what happens to communities and to the economy in a world with an increasingly volatile climate is no small task (and highly dependent on the preventive and mitigative actions we take in the immediate future). But, when the CBO has attempted to quantify the economic impact of future climate events on GDP, it’s made several conservative assumptions that have led to underestimates. As seen in its September 2020 Projection of the Effect of Climate Change on US Economic Output, the CBO:

- Assumed a middle-case scenario for climate change, and did so by averaging the results of the best- and worst-case scenarios from the representative concentration pathway (RCP), a climate model whereby each RCP describes a different concentration of greenhouse gases in the atmosphere. Without immediate and aggressive climate action, the CBO cannot reasonably assume that the US won’t experience a worst-case climate scenario in the future;

- Examined historical regional weather patterns in order to extrapolate possible future impacts of climate change on economic output;

- Only accounted for hurricanes, and not other climate disasters that will increase in frequency and intensity with time—like forest fires and droughts; and

- Only considered conclusive impacts to GDP, and not impacts to well-being or any indirect economic impacts stemming from migration changes, social upheaval, or international economic conditions.

Incorporating these assumptions into its projections, the CBO found that climate change will reduce US GDP in 2051 by 1 percent from what it would have been if climatic conditions from 2021 to 2051 were the same as they were at the end of the 20th century. This grossly understates the looming economic threat of climate change. Comparatively, a 2019 paper from the National Bureau of Economic Research, Long-Term Macroeconomic Effects of Climate Change: A Cross-Country Analysis, found that the US could see GDP fall by as much as 5 percent by 2050 and 14 percent by 2100; other estimates of losses are as high as 36 percent by 2100.

The CBO adheres to a narrow budget window and adopts traditional definitions that undermine the full impact of federal investment.

Since its creation in 1975, the CBO has been tasked with analyzing proposed federal budgets and producing cost estimates of major congressional legislation. As such, the CBO typically conducts its analysis using the 10-year period used in the congressional budget process. But when costs and economic impact are measured in 10-year intervals, any benefits of federal investments that fall outside of that interval are necessarily disregarded in the CBO’s estimates.

This narrow budget window is especially problematic for assessing the full impact of climate mitigation and adaptation investments. The benefits of these efforts, as the CBO acknowledges in its April 2021 report, will be spread over “decades or even centuries.” Similarly, federal investments in education and research and development (R&D) may take more than a decade to affect economic output, according to the CBO’s June 2016, The Macroeconomic and Budgetary Effects of Federal Investment. In fact, the CBO projects in that same June 2016 report that only after 20 years will the full amount of a given $1 billion investment reach its peak impact. Thus, the CBO’s adherence to the 10-year budget window ignores the full benefits of public investment in climate policy, education, and technological R&D, all of which may take decades to become fully productive.

Additionally, as the agency’s name suggests, the CBO is solely focused on the federal budget (i.e., changes to federal outlays and revenues). Prioritizing these metrics creates a situation whereby the CBO, in its published assessments, is more concerned about the narrow budgetary costs of specific programs than the broader economic, social, and human costs of inaction on these issues. As a stark example, the CBO admits in its April 2021 report that inaction on climate policy could actually have a positive effect on the federal budget:

The future effects of climate change on mandatory spending are complex, as illustrated by the effects of illness and mortality on four of the largest mandatory programs—Social Security, Medicare, Medicaid, and Supplemental Security Income (SSI) . . . The costs of those programs would be expected to increase if people retired earlier or disability rates increased. As with Medicare and Medicaid, the costs of those programs will decline to the extent that participants die at younger ages.

In other words, the CBO sees a potential budgetary benefit to climate catastrophe: If more people die younger, mandatory spending programs will become cheaper for the federal government to operate. This ruthless conclusion is the result of prioritizing a spending policy’s budgetary impact at the expense of any and all social benefits to such spending.

Lastly, the CBO’s definition of “investment” fails to account for the full range of what federal investment can and should be. In its June 2016 report, the CBO broadly defines investments as government expenditures that increase private-sector productivity:

The federal government buys many goods and services that are expected to increase private-sector productivity—that is, the ability of the private-sector workforce, using the stock of capital, to produce goods and services. Such purchases by the federal government are called investment.

The CBO then splits this expansive category into three subgroups: 1) physical capital, 2) education and training, and 3) R&D. While “traditional” investments like those for roads and bridges would easily nest under these subcategories, other much-needed programs won’t fit so neatly.

The inevitable result of adhering to these inflexible definitions is that the CBO simply doesn’t consider certain types of public spending to be investments. While the CBO does state that climate mitigation and adaptation spending should classify as investment, it doesn’t consider spending on programs like health care or school lunches to be investment. The CBO writes in its June 2016 report:

. . . the empirical link between increases in federal spending on health care and greater private-sector productivity is relatively tenuous, so CBO does not currently regard federal spending on health care as investment.

But policies that enhance the health and well-being of the US population understandably result in an overall better economy, in which workers are more productive and families less likely to be bogged down by poverty and illness. There’s a well-documented, wide-ranging literature showing that expenditures in health care and social insurance have a positive impact on economic performance, income, GDP, and labor productivity.

The CBO assumes that federal investment has half the rate of return of private investment.

The CBO’s June 2016 report makes several assumptions about the potential payoffs of investment and concludes that federal investments have a much lower rate of return than does private investment, stating:

In CBO’s macroeconomic models, the central estimate of the average return on new federal investment—which includes spending for physical capital such as highways as well as spending for education and for research and development—is about one-half as large as the return on private investment in the economy.

This assumption is driven by the CBO’s assumption that “public investment is three-fourths as high as the average productivity of private investment” and that an increase in federal investment is partially offset by a decrease in state and local investment. In fact, the CBO estimates that “a $1 increase in federal investment reduces investment by states, localities, and private entities by one-third of a dollar.”

In assuming the above, the CBO glosses over the unique contributions of various forms of public spending and undercuts the full benefits of federal investments. It assumes that, rather than taking on important investments that states and municipalities will not make on their own, the federal government, in large part, simply replaces that spending. But in fact, many federal spending programs—including the CARES Act—contain Maintenance of Effort (MOE) provisions that explicitly require that federal funds supplement (not supplant) state investment. This is noteworthy, as it is necessary for the federal government to carry out key investments—like those in fighting climate change and building up industrial capacity—that states and municipalities won’t make on their own.

While the CBO acknowledges that different types of investment “no doubt have different rates of return,” it doesn’t account for this variation, and instead utilizes a central average, stating:

Rates of return can be different for different types of investment, but because the current empirical literature does not offer a satisfactory way to estimate different rates of return for all of those types, the illustrative policies examined in this report use a single rate. That single rate reflects CBO’s current best estimate of the average return on different federal investments.

Importantly, these assumptions mean that the CBO could severely downplay the future economic impact of the much-needed federal investments being considered now in the American Jobs and American Families Plans. It assumes that private businesses and local governments are both better and more willing to carry out the investments we need, when experience tells us that this won’t happen otherwise.

The CBO assumes that deficit-financed federal investment would raise interest rates, crowd out private investment, and result in future negative economic growth, independent of the economic trends we’ve seen in the past 20 years.

In its June 2016 report, the CBO makes several assumptions about the macroeconomic effects of increased public investment—particularly that which is deficit-financed—and concludes that public investment can trigger a negative growth path.

For one, the CBO rightly assumes that public investment financed by additional federal borrowing would raise overall economic productivity and GDP, but also incorrectly assumes such spending would reduce private investment by 33 cents for every dollar the federal deficit increases. The CBO explains:

If a change in federal investment is not financed by offsetting changes in other spending or revenue policies, it must necessarily be financed by a change in federal borrowing. That change affects output in the longer term by affecting private investment. Increased federal borrowing reduces the amount of money available for private investment—a phenomenon called crowding out.

In that same June 2016 report, the CBO makes an overly simplistic prediction that the Federal Reserve, in response to any increase in public investment, will raise interest rates:

Regardless of how it is financed, a change in federal investment also eventually affects interest rates. Increases in investment result in higher interest rates, and decreases result in lower ones.

The CBO elaborates on this rationale, stating:

Moreover, CBO estimates that [with an increase in total federal deficit spending] interest rates would rise, increasing the federal government’s interest payments, not only because of higher productivity but also for two more reasons. First, the increased government spending would raise overall demand, and the Federal Reserve, in CBO’s view, would respond by raising short-term interest rates to prevent inflation from rising above the central bank’s longer-term goal. Second, the increased borrowing would reduce the amount of money available for private investment, thereby heightening competition for investors’ money.

Increased federal investments that jump-start demand are especially vital during economic downturns, when aggregate demand is low, as it is now. The CBO acknowledges this point, but concludes that since in their estimation “such effects are uncertain . . . the CBO does not incorporate them into its analyses, but it continues to investigate the issue.”

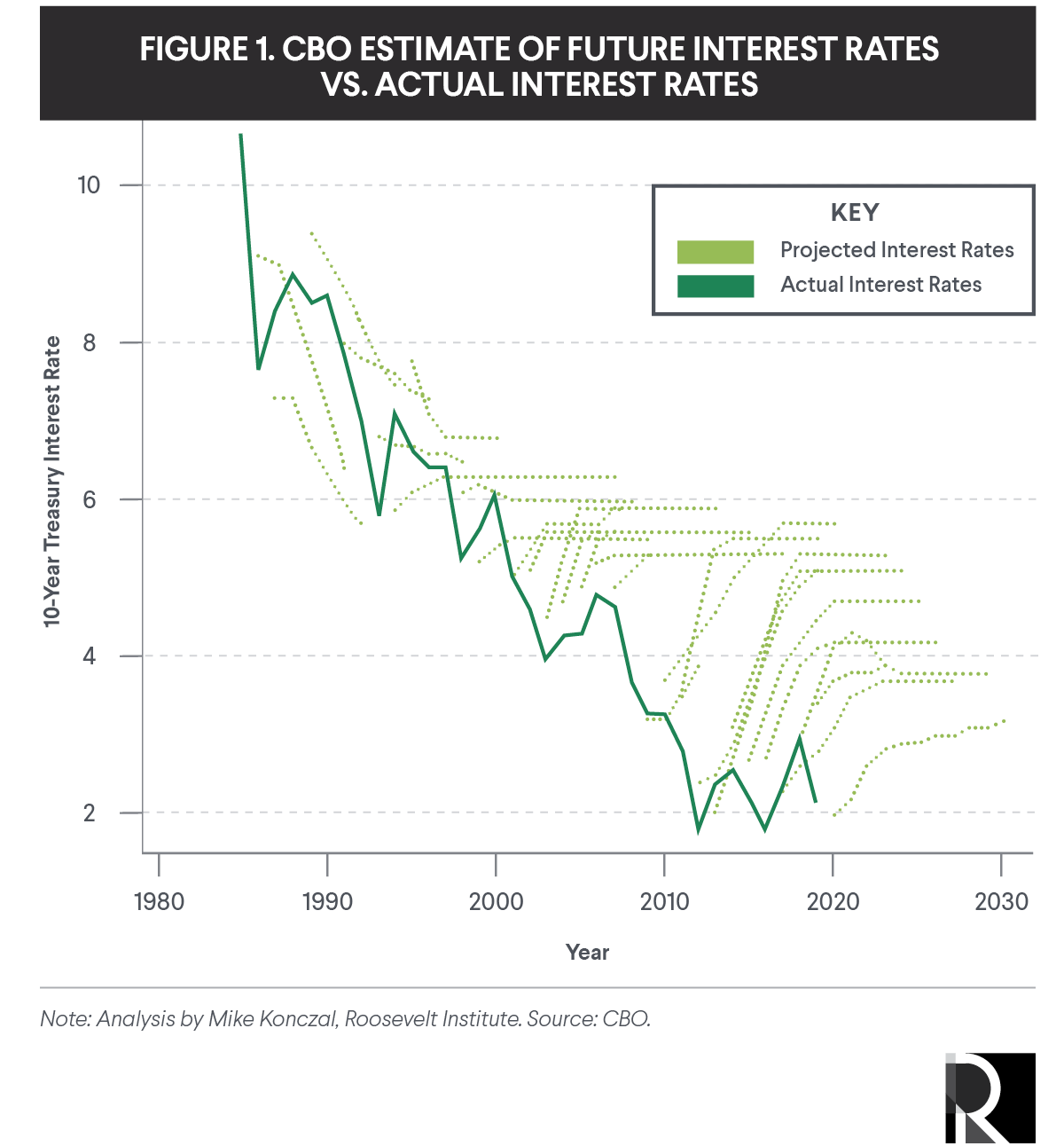

There are three problems with this approach. First, it leads the CBO to overstate interest rates and, by extension, make the cost of spending programs appear much larger than they actually are. Since the mid-1990s, the CBO has routinely predicted higher interest rates than what has actually occurred. The graph below shows its predictions of the future path of interest rates in each year, versus the reality. The CBO itself knows its tendency to overshoot predictions, stating in a September 2019 report, An Evaluation of CBO’s Past Deficit and Debt Projections, that “CBO has overestimated interest rates since 1997, causing the agency’s projections of interest costs to be too high.”

Second, it ignores the actual, professed policies of the Federal Reserve. The Fed follows a 2 percent inflation target for its monetary actions. In late 2020, the Fed changed this system to an average inflation target regime, designed to better allow the economy to catch up following depressed periods of recessions. In both cases, the Federal Reserve doesn’t set rates based simply on deficit spending but instead on how that deficit spending interacts with economic slack and recovery as measured through inflation.

Third, by extension, it assumes that the economy is always at or near full employment. For the CBO to assume that any spending must offset private investment, or that it necessarily raises interest rates, is to assume that government investments can’t play a meaningful role in either recovering from recessions or increasing the productive frontier of the economy and easing the bottlenecks that can cause inflation.

Since the CBO only counts revenues that result from legislation if such legislation changes the tax code, any revenues from expanded IRS enforcement are ignored.

After decades of IRS defunding that has benefited wealthy and corporate taxpayers, the Biden administration has proposed an increase to IRS funding. However, the CBO’s methodology in addressing changes to tax revenue will inevitably understate such changes when they stem from enhanced IRS enforcement like the kind the Biden administration has outlined.

First, the CBO’s estimates only consider the direct impact of increasing the IRS’s funding. In a July 2020 report, Trends in the Internal Revenue Service’s Funding and Enforcement, the CBO estimates that increasing the IRS’s funding by $20 billion over 10 years would raise federal revenues by $61 billion, and increasing such funding by $40 billion over 10 years would increase revenues by $103 billion. But these estimates “only capture the direct effect of enforcement activities,” the CBO writes, and any “indirect benefits of increasing enforcement, such as deterring taxpayers from violating tax laws, are excluded from the estimates.” In other words, CBO estimates don’t capture the indirect effects that ramped-up IRS funding and enforcement would have on deterring would-be tax evaders.

Additionally, the CBO also makes several assumptions in calculating these hypothetical revenue estimates about the return on investment of expanded enforcement, including that:

- Finding enough new IRS employees and training them sufficiently would become increasingly difficult and costly; and

- Taxpayers would eventually adapt to enhanced IRS enforcement and find new ways to dodge taxes. The CBO writes, “After the third year of an [enforcement] initiative, taxpayers will have adapted to a new enforcement activity and developed ways to evade that enforcement. CBO therefore reduced the marginal return on each activity after the third year.”

Last, the CBO only incorporates revenue changes into its assessments if those revenues result from changes to the tax code itself, stating:

Put another way, potential revenues from legislation will be counted in a cost estimate only if those revenues result from changes in the tax code. Even though additional discretionary appropriations for IRS enforcement may produce budgetary savings (from increased federal tax receipts), such savings are not counted in a cost estimate.

In other words, the budgetary savings from enhanced IRS enforcement activity likely wouldn’t “count” in the CBO’s assessment because such changes would stem from IRS enforcement policy and not from official changes to the US tax code.

Thus, for any large-scale infrastructure package, CBO cost assessments that include IRS funding for enhanced enforcement would ignore potentially huge revenue increases.

Conclusion

The CBO’s methods, like the methodology of all forecasts and analysis, have strengths and weaknesses. Part of policymaking is understanding these strengths in order to best deploy them, and weaknesses in order to best correct for them. Unfortunately, when it comes to the question of investments being considered right now, the CBO’s methods are poorly situated to give us clear answers.

This is most noteworthy when it comes to the climate crisis. We know several things are true when it comes to climate change: the human and economic cost of inaction is massive; the federal government is uniquely situated among private actors and state governments to act; these investments will help with our recovery and our economy’s long-term economic potential; and the federal government also has the time frame to see out these actions and investments.

However, the CBO’s methodology discounts, ignores, or otherwise assumes away all of this. According to the CBO’s assumptions, the federal government is poorly positioned to fight climate change, any federal attempts to do so will largely replace private and local efforts, the economy is near full employment, and the federal government lacks the ability to sufficiently increase potential output. The CBO looks at such a short time period that it ignores the true devastation of what climate change will do. These are not the tools we need to solve the most pressing problems facing our country.