Fast-Food Industry Profiteering: Why California Businesses Can Absorb a Higher Minimum Wage

March 28, 2024

By Alí R. Bustamante, Ira Regmi

Introduction

Effective April 1, 2024, California fast-food workers will be paid at least $20 per hour as part of legislation enacted last September that established an industry-wide minimum wage and created a Fast Food Council of worker, business, and state representatives to develop recommendations for industry standards, rules, and regulations (Office of Governor Gavin Newsom 2023).1 The new fast-food minimum wage will be $4 higher than California’s general $16 per hour minimum wage, a significant win for workers in one of the lowest-paid industries. Further, the new Fast Food Council will give fast-food workers a formal seat at a negotiating table with oversight over working conditions.

While the law is a win for workers and the labor unions that have long fought for improved working conditions in the fast-food industry (SEIU 1021 2023), some employers perceive the law as a financial threat (Moorcraft 2023). In the months leading up to the minimum wage increase, fast-food firms have suggested looming price increases and job cuts (see, for example, Luna 2024; Woods 2023). Yet our analysis of financial data for the past decade finds increases in fast-food industry operating profits and rising markups, suggesting that affected employers can absorb the increased operating costs associated with a higher industry minimum wage without increasing consumer prices or reducing employment.

"Corporations have accumulated significant market power over the years, enabling them to charge more than what a competitive market would allow. In effect, this means that firms are able to increase prices without sacrificing profit."

According to Mike Konczal and Niko Lusiani’s “Prices, Profits, and Power” (2022), corporate profit margins and markups in 2021 grew at the fastest annual pace since 1955. Their research finds that the recent high jump in corporate profit margins and markups—the difference between the prices consumers pay and the cost of production—is evidence that inflation is being driven, in part, by corporate profiteering related to firms’ price-setting power. Corporations have accumulated significant market power over the years, enabling them to charge more than what a competitive market would allow. In effect, this means that firms are able to increase prices without sacrificing profit. This recent spike in corporate profiteering should inform how we account for the impact of California’s fast-food minimum wage on corporate employers. Outsized corporate profit margins driven by increased markups throughout the industry provide evidence that now, more than ever, fast-food employers can absorb higher wage costs without raising prices or reducing employment.

In response to the implementation of California’s fast-food minimum wage, affected corporations can simply narrow the gap between prices and the cost of production and still maintain profitability.

This brief provides evidence of increasing corporate profit margins and markups in the fast-food industry and of a strong fast-food labor market in California and across the US. We find that firms in the fast-food industry increased markups during the past decade, which drove record-level profit margins in 2023. Additionally, we find that California’s fast-food industry has experienced robust growth in both employment and the number of establishments over the past decade, but that the wage gains of California’s fast-food workers have been undermined by inflation. We conclude that increasing the minimum wage for California’s fast-food workers can offset the real wage decline caused by the brief inflationary period of 2022–23 and that the industry’s operating profit margins provide sufficient room to absorb higher wage costs.

Fast-Food Industry Markups and Profit Margins

Much of the fast-food industry has drastically increased markups during the past decade, helping pave the way for record-level industry profit margins above and beyond other sectors’ growth. While not all firms have followed this strategy, the largest firms have, forcing consumers to pay for their higher profits through unnecessary increases in prices. Between 2014 and 2023, fast-food prices increased by 46.8 percent compared to 28.7 percent for the average of all prices.2 Evidence of fast-food firms’ recent profiteering makes it clear that the upcoming implementation of a fast-food minimum wage of $20 per hour in California will not necessitate price hikes or employment losses, because profits in the industry are sufficiently high to absorb the greater operating costs.

In 2023 alone, the 10 largest publicly traded fast-food companies spent $6.1 billion on share repurchases.3 To put this into perspective, if we estimate the cost of the minimum wage increase for affected employers using the most generous—and unrealistic—assumptions, employers’ wage costs will increase by a maximum of $4.6 billion annually.4 This figure is notably less than the amount the top companies spent on share repurchases, indicating that most affected employers could cover the expense of the minimum wage increase by merely decreasing their share repurchases. Further, these 10 firms made $20.9 billion in total operating profits in 2023 suggesting considerable room on their income statements to cover wage increases.

Profit Markups

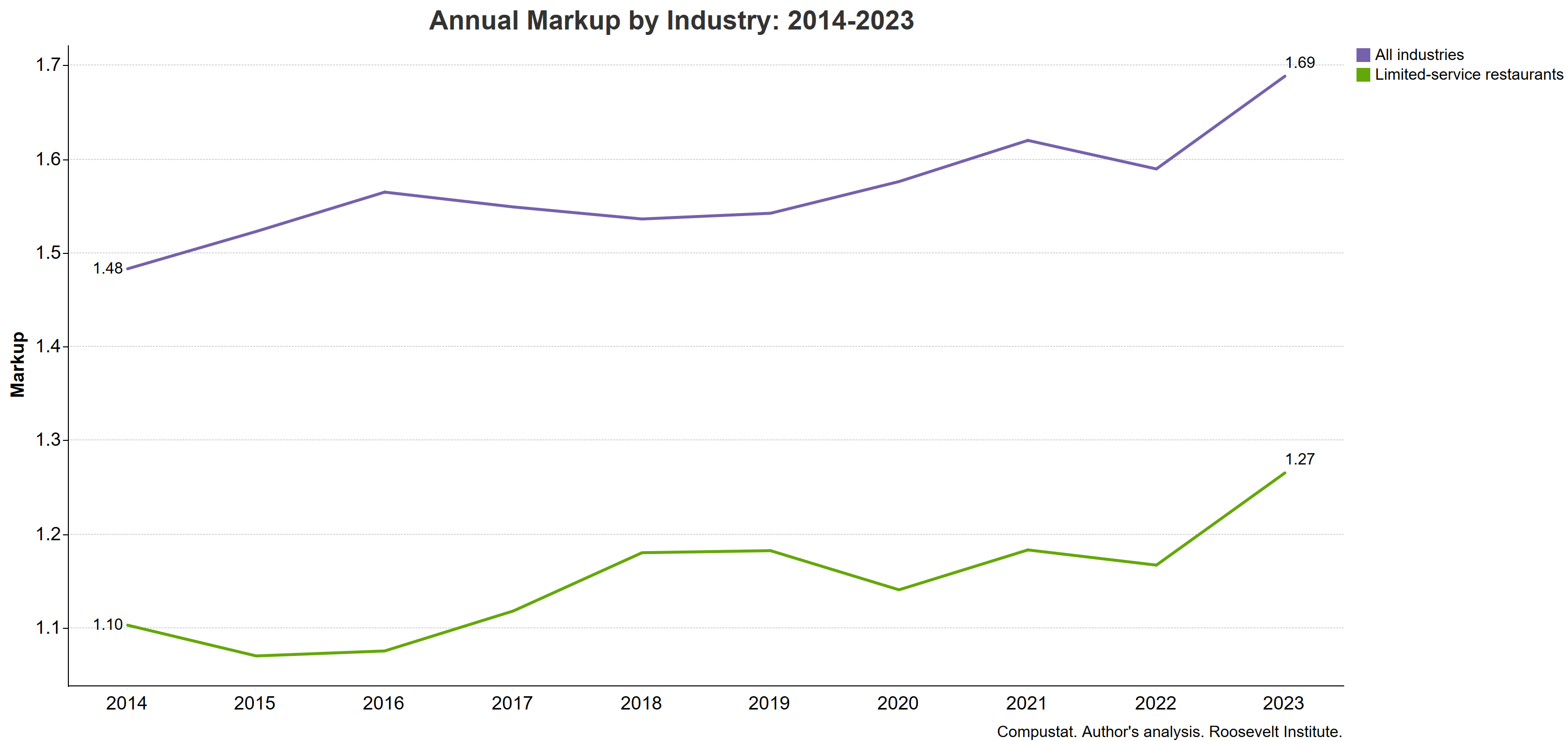

Applying Konczal and Lusiani’s (2022) methodological approach to estimating markups, we find that on average, markups increased by 13.9 percent across all firms during the past decade and by 14.7 percent in the fast-food industry (limited-services restaurants) (see Figure 1).5 In 2023 alone, the average markup in the fast-food industry jumped by 8.4 percent while markups for firms across all industries grew by 6.2 percent. The recent spike in markups means that in 2023, fast-food firms charged prices that were 27 percent above the marginal cost of production.

As with most industries, the fast-food industry has historically charged higher prices than their marginal costs. However, between 2014 and 2023, markups increased at an annual rate of 2.2 percent, faster than at any period since 1978. As a result, fast-food firms have developed an increasingly large buffer between costs and prices that has better positioned them to absorb higher operating costs now, more so than in the recent past. On average, publicly traded firms distribute all corporate profits to shareholders via stock buybacks and dividends on stock (Palladino and Lazonick 2021). This means that markups have only benefited wealthy stock owners and hedge funds. In sharp contrast, minimum wage increases have the potential to shift corporate profits inward, back into the company, rewarding the workers that drive productivity in the first place.

Figure 1

Our analysis of 10 of the largest publicly traded fast-food firms shows that markups have increased substantially at 5 firms during the past decade.6 Markups increased most at Wendy’s and McDonald’s, by 76.2 percent and 40.3 percent respectively between 2014 and 2023. In 2023, markups were the highest among Wendy’s, where prices were 91 percent above marginal costs, McDonald’s (85 percent), and Restaurant Brands International (80 percent). Markups at Yum! Brands and Domino’s Pizza were 45 percent and 19 percent respectively, closest to the fast-food industry average of 27 percent.

Footnotes

Read the footnotes

1The law defines fast-food chains as “limited-service restaurants consisting of more than 60 establishments nationally that share a common brand, or that are characterized by standardized options for decor, marketing, packaging, products, and services, and which are primarily engaged in providing food and beverages for immediate consumption on or off premises where patrons generally order or select items and pay before consuming, with limited or no table service.”

2See US Bureau of Labor Statistics Consumer Price Index series CUUR0000SA0 and CUUR0000SEFV02.

3The total shares repurchased includes common and preferred stocks.

4To arrive at this estimate, we assume that all workers in the industry (approximately 552,000) receive a $4 per hour raise (going from $16 to $20). We further assume that they all work 40 hours per week for 52 weeks per year.

5Firm and industry markups are derived from sales divided by the cost of goods sold multiplied by an industry- and year-specific production function and are adjusted for firm size, employing data from Compustat. The sales and cost figures are adjusted for inflation.

6Our analysis includes: Chipotle Mexican Grill, Domino’s Pizza, Jack in the Box, McDonald’s, Papa Johns International, Restaurant Brands (Burger King, Tim Hortons, and Popeyes), Shake Shack, Starbucks, Wendy’s, and Yum! Brands (Pizza Hut, Kentucky Fried Chicken, and Taco Bell). We do not include firms like Darden Restaurants, CAVA group, and Wingstop Restaurants, which are among the largest firms by market capitalization but are not subject to the California minimum wage legislation or were not publicly traded prior to 2015.