The Causes of and Responses to Today’s Inflation

December 6, 2022

By Joseph E. Stiglitz, Ira Regmi

The evidence is overwhelming: were there no supply problems, aggregate demand would not be excessive. The inflation we’ve experienced is best understood as resulting from industry-specific problems that many Organisation for Economic Co-operation and Development (OECD) countries are facing. A strong labor market is part of the solution, not the problem.

Over the last couple years, the world has experienced the highest levels of inflation in more than four decades. There are multiple sources of economic disruption that have likely contributed to this inflation, most notably pandemic shutdowns and reopenings and Russia’s invasion of Ukraine. The inflation, in turn, has sparked a debate about its causes, with some claiming it is demand-induced, largely the result of high spending in response to the pandemic. Others focus on pandemic-induced supply shortages and demand shifts, possibly exacerbated by market power and market manipulation. While there may be elements of all of these, the policy response needs to address the dominant cause. If it’s a result of excessive aggregate demand, then monetary policy—reducing aggregate demand through monetary tightening—is appropriate. If it’s largely supply-driven, a more tailored response is required, including fiscal policy that alleviates the supply constraints.

Our analysis concludes that today’s inflation is largely driven by supply shocks and sectoral demand shifts, not by excess aggregate demand.

Monetary policy, then, is too blunt an instrument because it will greatly reduce inflation only at the cost of unnecessarily high unemployment, with severe adverse distributive consequences. This paper presents a variety of fiscal and other policy measures that hold out the prospect of having a more significant effect on inflation. In particular, these measures would reduce inflation’s impact on the most vulnerable and provide long-term benefits to the economy without the likely high costs of excessively rapid and large increases in interest rates.

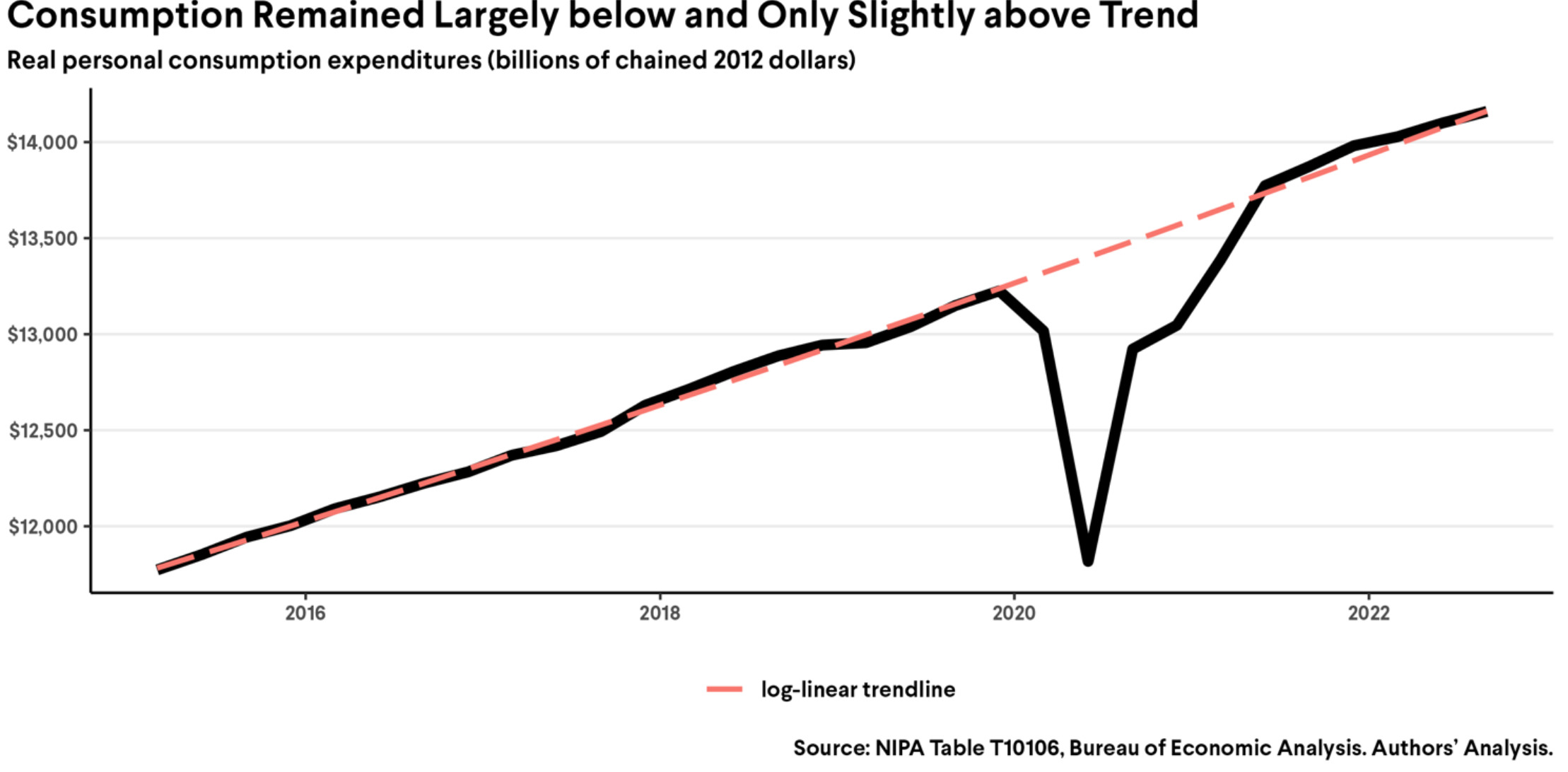

We look at both the aggregate and sectoral-level data, and show, notably, that real personal consumption has largely been below trend, particularly in the periods when inflation heated up, and total real aggregate demand has been consistently below trend, which reinforces the conclusion that the “problem” arises from the supply side.

As seen in the Figure above, real personal consumption has largely been below trend, particularly in the periods when inflation heated up. In addition, with three fiscal quarters of anemic growth, from the fourth quarter of 2021 to the second quarter of 2022, it is hard to see how excess demand by itself could be at the root of the problem.

Is today’s inflation the result of excessive aggregate demand, or is it the result of overlapping sectoral supply side shifts and shocks? We just released a new paper by @JosephEStiglitz and @Regmi_Ira making a wide-ranging case for the latter. 🧵(1/8) https://t.co/TTVBUoOXwo

— Roosevelt Institute (@rooseveltinst) December 6, 2022

With three fiscal quarters of anemic growth, from the fourth quarter of 2021 to the second quarter of 2022, it is hard to see how excess demand by itself could be at the root of the problem. Moreover, inflation in the United States is no worse than in other countries even as Americans saw a more robust recovery, largely because we had more fiscal support. A sectoral breakdown of inflation, as well as a closer look at the patterns in the timing of inflation, further support the conclusion that excessive spending during the pandemic is not the principal cause of today’s inflation.

Breaking down inflation by sector reveals that it is tied to the obvious shocks and supply chain interruptions the economy has experienced, from high food and energy prices to the shortage of microchips for automobiles.

We also explain how the large pandemic-induced shifts in demand, such as those associated with housing, have contributed to today’s inflation.

Another important factor is the increase in market concentration, which has generated greater market power; the current circumstances have provided a prime opportunity for a greater exercise of that market power.

A Wage-Price Spiral?

The paper also addresses the concern that inflation will seep through the economy, regardless of its original source, as a wage-price spiral is set in motion. We conclude that with nominal wages already tempered, this does not seem likely. Moreover, declining real wages are typically not a sign of a tight labor market. Weak unions, globalization, and changes in the structure of the economy provide part of the explanation for why wage-price dynamics today may be markedly different from 50 years ago.

Conventional economics worries that inflationary expectations might perpetuate inflation; but so far, inflationary expectations appear mild, perhaps because many market participants agree with our analysis that the underlying sources of today’s inflation are supply side interruptions, less temporary than people had hoped for at the onset of the inflation, but temporary nonetheless. Recent data are consistent with this perspective: While inflation does vary considerably month to month, it is heartening that it has slowed over the last four months to 2.8 percent (BLS CPI; authors’ calculations)—a slowing consistent with the supply side interpretation, but inconsistent with the standard macroeconomic demand-side analysis. (Because there was higher month-over-month inflation at the end of 2021 and the beginning of 2022, the year-over-year rate remains high at 7.7 percent.) The New York Federal Reserve’s “Underlying Inflation Gauge” peaked in July 2022 at 4.9 percent, and by October 2022 was at 4.2 percent.

The Right Policy Response

This analysis provides a different perspective from conventional economics on the appropriate policy responses to current inflation. Conventional wisdom, partly based on a wealth of experience in which demand shocks have given rise to inflation, holds that interest rates should be increased when there is inflation, whatever the cause. Interest rates worldwide have been abnormally low, partly because of the excessive reliance on monetary policy in response to the 2008 financial crisis. But the cost of capital should not be zero (or worse, negative).

Restoring interest rates to more normal levels has distinct advantages. Going beyond that—raising them too far and too quickly—is problematic, especially given the buildup of debt in the era of near-zero interest rates.

Most importantly, such increases in interest rates will not substantially lower inflation unless they induce a major contraction in the economy, which is a cure worse than the disease. An economic downturn like that is likely to have long-lasting adverse effects, and the most marginalized in society will bear the brunt. Volatile energy and food prices are largely internationally driven and not under the control of the Federal Reserve. The recent aggressive hikes have not remedied these price increases and are unlikely to do so in the future. Inflation induced by these price fluctuations may come down (as it has recently in some months in the United States), but not because of Fed action. To the contrary, the paper explains several reasons why large and rapid increases in interest rates, beyond normalizing them, may be counterproductive. For instance, they could impede investments that might alleviate some of the supply shortages.

By contrast, well-designed fiscal and other policies can help to ameliorate the supply shortages, tame inflation, and protect the vulnerable, providing long-term benefits even if it should turn out that inflationary pressures are transient.

Key Takeaways

#1

Today’s inflation comes mostly from sectoral supply-side disruptions, largely the result of the COVID-19 pandemic and its consequent disturbances to supply chains, as well as disruptions to energy and food markets originating from Russia’s invasion of Ukraine. Demand patterns too have undergone significant changes, again largely induced by the pandemic. In some sectors, these effects have been amplified as a result of the exercise of market power. But today’s inflation, for the most part, is not the result of significant excesses of aggregate demand such as might have arisen from excessive US pandemic spending.

#2

While we welcome the return of interest rates to more normal levels, which reduces a number of distortions associated with persistent, abnormally low interest rates, increasing interest rates too far and too quickly risks a painful slowdown to the economy with minimal benefits to inflation short of a significant downturn. This would have particular adverse distributional consequences, especially for marginalized groups in the country.

#3

There are fiscal and other measures that can and should be taken to alleviate particular sectoral inflationary pressures, and that are likely to be more effective than broad-based interest rate increases.

#4

Recent data shows significant moderation of inflationary pressures, with nominal wage increases in particular being only a little over pre-pandemic levels. This, together with other indicators such as tempered inflationary expectations, goes a long way in alleviating worries about an incipient wage-price spiral.

Explore more of our work on inflation

Is it Time for the Fed to Pause

EventThe Roosevelt Institute hosted a webinar to discuss this report, The Causes of and Responses to Today’s Inflation, by Joseph Stiglitz and Ira Regmi, who find that today’s inflation is largely driven by supply shocks and sectoral demand shifts.